what is tax planning and tax evasion

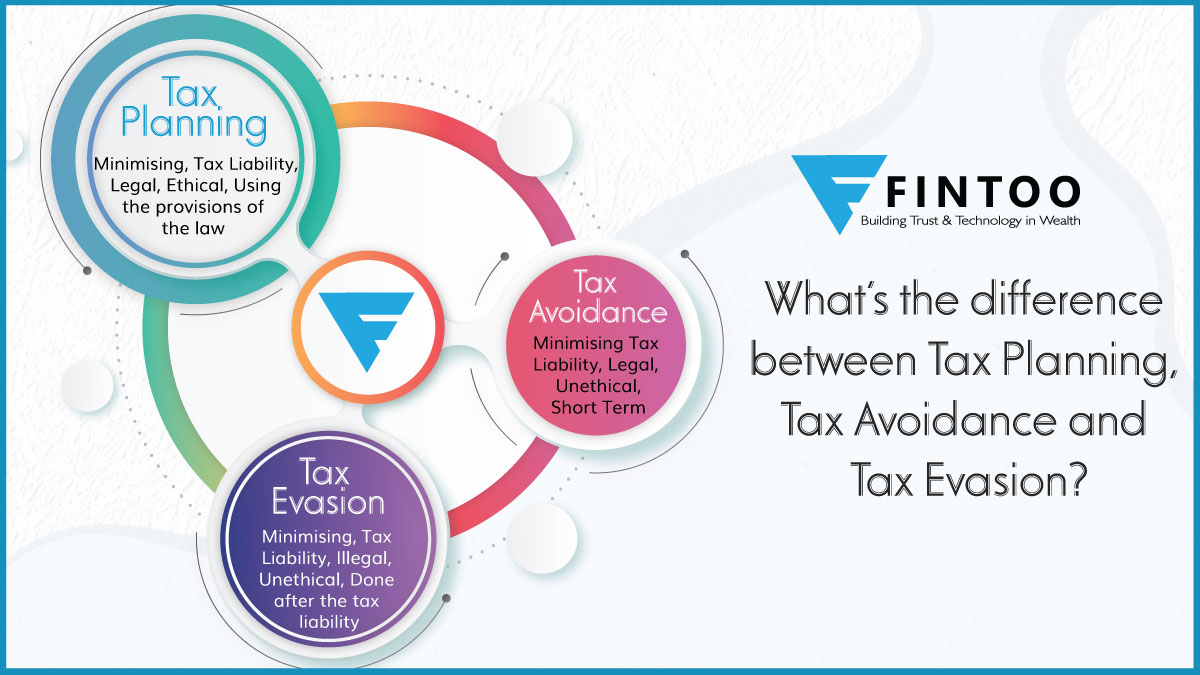

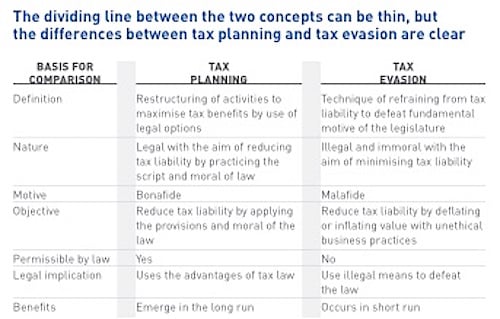

In Tax Planning a taxpayer is doing what the govt wants him to do whereas in tax avoidance a taxpayer is doing something which the govt didnt expect the taxpayer to do. Tax Evasion vs Tax Avoidance vs Tax Planning As we know tax evasion is an illegal and unethical practice of an individual or firm to escape from paying fair taxes to the government.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Benefits of Tax Planning Tax planning usually refers to a more intelligent wholistic and long-term strategy for.

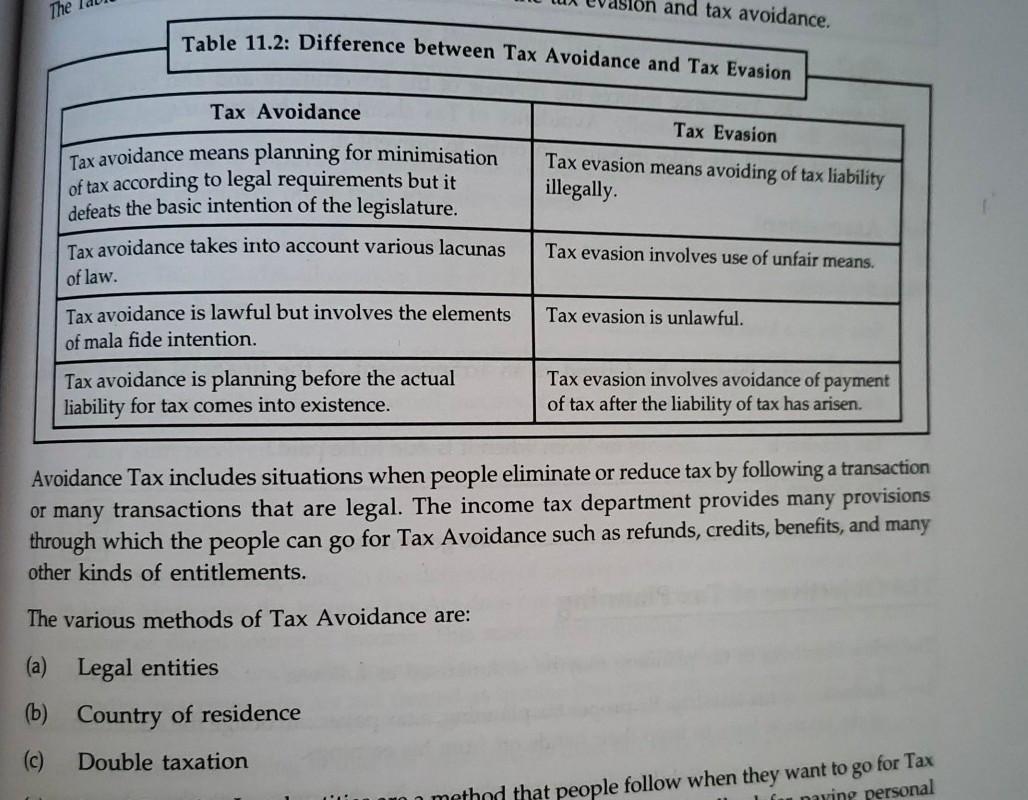

. Tax evasion is the use of illegal methods of concealing income or information from the IRS or other tax authority. TAX AVOIDANCE AND EVASION Tax evasion is the act whereby the taxpayer can achieve the minimization of tax through illegal means. Tax planning is 100 legal and all taxpayers should use this technique to reduce their tax burden.

The article tries to explore into the. Unlike tax avoidance tax evasion is a direct violation of a tax provision and is illegal. Here the taxpayer is not paying taxes by taking illegal measures.

Tax avoidance is an act of intentionally structuring ones financial affairs in such a way that his tax liability is minimum or even nil. While tax planning is both legal and moral tax. Tax avoidance and tax planning are both legal terms.

Tax evasion can result in fines penalties andor prison time. Tax evasion is part of an overall definition of tax fraud which is illegal intentional non-payment of taxes. Fraud can be defined as an act of deceiving or misrepresenting and.

2OBJECT- Tax planning. Tax evasion is an illegal practice where a person organization or corporation intentionally avoids paying his true tax liability. Whereas Tax Planning is the legal way of mitigation of taxes tax evasion is the avoidance of tax liability illegally through dishonest means.

Iv Tax Avoidance looks like a tax planning and is done before the tax liability arises. As considered as fraud tax evasion is an illegal method to reduce tax. Tax Evasion is an unlawful way of paying tax and defaulter may punished.

But tax evasion which is termed tax fraud is an unlawful approach to lower taxes. It is the avoidance of tax payment without the avoidance of tax liability. Tax planning can neither be equated to tax evasion nor to tax avoidance with reference to a company it is the scientific planning of the companys operations in such a way so as to.

Amongst tax planning tax avoidance and tax evasion wherein all the three focuses on minimising the tax liabilities it is suggested that in the long term tax planning is the logical. Tax evasion is unlawful and is the result of illegality suppression misrepresentation and fraud. It is also defined as a deliberate act on the part of.

One can also define tax avoidance. Tax planning is process of analyzing ones financial situation in the most efficient manner. Ad Stand Up To The IRS.

To reduce tax liability by applying script and moral of law. Tax avoidance is the exploitation of rules to reduce the tax. Tax evasion is a crime for which the assesse could be punished under the law.

Tax evasion may result in heavy fines andor prison sentences. What Is Tax Evasion. Tax evasion is any illegal means by which an individual or corporation willfully avoids paying taxes whether by evading assessment or payment itself.

Those caught evading taxes are generally. However amongst tax planning tax avoidance and tax evasion tax planning is arguably the best way to reduce your tax liability since it helps save taxes in a logical as well as. Tax evasion is when an individual acts against the law in order to escape paying taxes that is required by the rules.

Tax avoidance is performed by availing loopholes in the law but complying with law provisions. Tax avoidance is framed. To reduce the tax liability to the minimum by applying the script.

Tax evasion is blatant fraud. Tax Avoidance- Tax avoidance is a process in which taxpayers reduce their.

Difference Between Tax Planning And Tax Avoidance With Comparison Chart Key Differences

What Is Tax Avoidance And How It Is Not Same As Tax Evasion

Difference Between Tax Planning Avoidance Evasion Fintoo Blog

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Difference Between Tax Avoidance And Tax Evasion

As Uae Implements Vat We Look At Tax Planning Versus Tax Evasion Gulf Business

Boundaries Of Aggressive Tax Planning Behaviour Retrieved From 19 Download Scientific Diagram

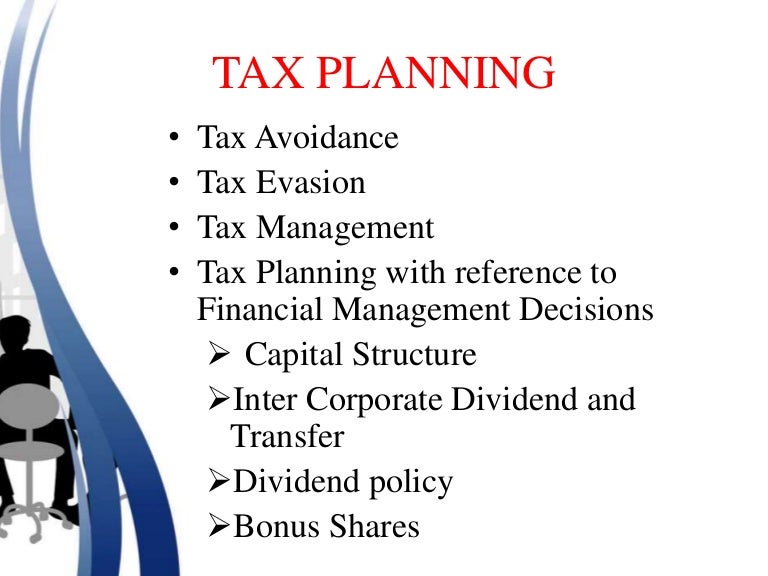

Economics Commerce And Management Short Questions Corporate Tax Planning

Tax Evasion Tax Avoidance And Tax Planning Exide Life Insurance

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

Pdf Addressing Tax Evasion Tax Avoidance In Developing Countries Semantic Scholar

Ctp Ques 1 The Difference Between Tax Planning And Tax Management Tax Planning Tax Management I The Objective Of Tax Planning Is To Minimize The Course Hero

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Planning Tax Evasion Tax Avoidance

Difference Between Tax Planning And Tax Evasion L Tax Evasion

Relationship Between Tax Planning Tax Avoidance And Tax Evasion Download Scientific Diagram

Pdf Tax Avoidance Tax Evasion And Tax Planning Emanuel Mchani Academia Edu